The Goods and Services Tax (GST) Bill, which is considered to be a landmark bill by many, won the favour of at least 203 members in Rajya Sabha earlier this year. The reason why it has attracted so much attention is because it is all set to give the tax system in the country a massive transformation and put India on the map with some of the other nations with prominent tax systems. The “one-nation-one-tax” system is expected to permit tax set off across the value chain while effacing the difference between goods and services.

The 122nd Amendment of the constitution was made in 2014, focusing primarily on smaller businesses which often face the burden of steep taxation. One of the sectors it is supposed to benefit is the manufacturing sector particularly the Small and Medium Enterprises (SMEs). Here’s a brief look at how,

Cheaper logistics and production: To increase the competitiveness within the manufacturing sector, the GST looks at cutting down the costs with respect to production, logistics and inventory. For example, many trucks face a delay at interstate borders due to location specific taxation. This time also accounts for 60% of the transit time and hampers both production and flow of logistics at companies. The GST ensures an undisrupted flow of goods between state, saving time, money and energy. It creates a tax neutral market and erases the difference between inter/intra state sales. This in turn leads to the creation of a central warehouse rather than crowding every state with a small warehouse.

It is expected that under the GST regime, effective indirect tax cost will come down and credit flow will increase, which will benefit the domestic manufacture with the reduction in production cost and also increase in base line profits. However currently, Indian Manufacturing sector remains one of the highest taxed sectors in the world.

|

Picture Courtesy: herofincorp

|

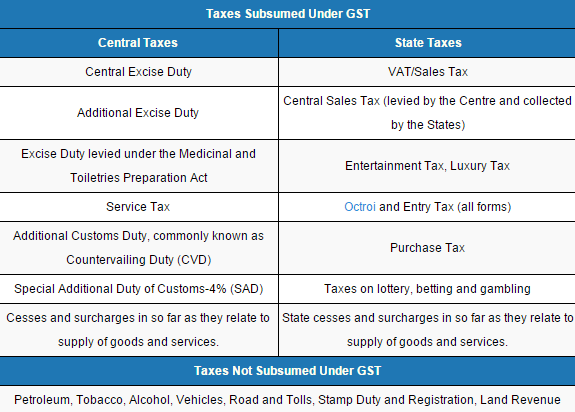

Input credit tax mechanism: One of the biggest hindrances on the way of SMEs is the Value-Added Tax (VAT) system as it requires SMEs to pay Central Sales Tax (CST) on inter-state sales deals. The GST instead instates an input credit tax mechanism, enabling the businesses to claim tax credits on inter-state purchases, import, local purchases etc.

An integrated tax system: A destination based tax, GST is payable at the point of consumption rather than at the point of production. As a result, the tax paid by the consumer would cover expenses incurred for sales.

Another thing to remember is that GST does not differentiate between the supply of goods or service. In such a scenario, the transaction values won’t also be needed to be split. How this benefits the manufacturing SMEs is that now they will need to pay only one integrated tax rather than pay a component based tax like VAT. They will also be entitled to get complete tax incentives which earlier needed to be paid before the production which included procurement of resources, services from various places etc.

Does Away with Dual Control: GST eliminates the dual control of the state and the centre that earlier used to create much pressure. With the unification of the tax system, it has inaugurated a business friendly environment that is conducive to doing business while at the same time increases profitability and quality of goods.

|

Picture Courtesy: gstindianews

|

Eliminating third part supply services: Due to lack of infrastructure and efficient logistics system, SMEs are often compelled to resort to third party supply chain services. GST does away with this problem by eliminating the interstate tax. This will prevent stalling of delivery of goods at inter-state points and ease the movement of goods via road.

Restructuring Supply Chain Model: It calls for a restructuring of the supply chain models, with the promise of a more efficient and cost-effective model. Currently, due to the VAT system that is in place, businesses try to locate multiple warehouses in every state rather than focus on creating a strategically planned inventory. This is done to avoid multiple taxes and reduce margins. As mentioned earlier, GST will allow firms to do businesses across states without making them pay interstate taxes or CST. Thus, GST promotes a strategic SCM model that is influenced by economic factors such as costs and location instead of non-economic factors, such as, inter-state VAT rate differences.

GST is all set to change the way manufacturing SMEs function. With lucrative prospects on the horizon, SMEs are getting ready to do some great work!

Register at SolutionBuggy to find manufacturing consultant / experts in quick time and get your projects done.

SolutionBuggy is an exclusive and dedicated platform for the Manufacturing Sector in India. It seamlessly bridges the gap between the industrial sector and professionals for on-demand consultation and services including projects. It connects SMEs and Large Scaled Industries with Industrial Consultants/ Experts and Industrial Product Suppliers over the internet for collaboration and success.

It is an integrated platform wherein industries can share their issues/ problems and post requirements; consultants/ experts can showcase their capabilities and offer services and solutions and suppliers can list their products to match the industry requirements.

Share

ConversionConversion EmoticonEmoticon